Latest DePIN News

9 months ago

Top 10 DePIN Coins to Watch in 2025

Decentralized Physical Infrastructure (DePIN) is rapidly emerging as a significant trend in the cryptocurrency landscape, particularly as we look towards 2025. By merging blockchain technology with tangible infrastructure, DePIN projects are providing distinct advantages for both consumers and producers, thus attracting the attention of innovators and investors. This article highlights the top 10 DePIN coins to monitor in 2025, which are distinguished by their robust market capitalizations and promising price trajectories, making them key players in this evolving sector.

Among the top contenders is Helium (HNT), which has garnered considerable interest from traders and long-term holders. Recent technical analysis indicates that HNT has formed a bullish harami candlestick pattern on the 200 Exponential Moving Average (EMA), suggesting a potential price surge of 30% towards $8.5. Similarly, Filecoin (FIL) is showing signs of recovery after a significant decline, with analysts predicting a possible rally of 65% if it maintains support above $4.90. Theta Network (THETA) and Internet Computer (ICP) are also positioned for potential upside, with THETA needing to break above $2.45 for a 36% increase, while ICP could see a 55% rise if it stays above $9.5.

Other notable mentions include IOTA, which has recently experienced a price correction but may rebound if it holds above $0.28, and Render (RENDER), which is poised for a breakout above $7.22. Additionally, Arweave (AR), Akash Network (AKT), AIOZ Network (AIOZ), and Hivemapper (HONEY) are all showing signs of potential growth, with analysts optimistic about their future price movements. As we approach 2025, these DePIN coins present substantial growth opportunities, particularly if favorable market conditions prevail, potentially delivering notable returns for investors.

9 months ago

Web3Bay's Successful Presale and Innovations in Crypto Market

In the ever-changing landscape of the cryptocurrency market, Cardano and Filecoin are demonstrating remarkable resilience and innovation. Cardano has experienced a significant price increase this year, reflecting strong market momentum, even as it recently dipped to $1.064. Analysts remain optimistic, predicting that the price could soar to $6 due to ongoing developments and heightened adoption. Meanwhile, Filecoin is making strides in the decentralized storage sector with its latest upgrades, including the "Waffle" upgrade, which enhances performance and compatibility with Ethereum. These advancements not only bolster Filecoin's interoperability but also broaden its appeal within the Web3 ecosystem, attracting developers and businesses alike.

Amidst these developments, Web3Bay (3BAY) has made headlines by successfully raising $830,000 in its latest presale, solidifying its position as a top investment choice during the current bull run. The platform aims to revolutionize the $5 trillion e-commerce industry by leveraging blockchain technology to improve transaction efficiency and user privacy. Central to Web3Bay's strategy is the 3BAY token, which offers a 5% discount on purchases and governance rights. The presale has already sold 220 million coins at a starting price of $0.004562625, with expectations of substantial price increases as new features like NFT integration and cross-chain capabilities are introduced.

As Web3Bay continues to evolve, it is set to launch innovative features that will further transform the e-commerce landscape. The project's commitment to transparency and user empowerment through blockchain technology is attracting a diverse range of supporters, reinforcing its status as a leader in the digital commerce revolution. With Cardano's inclusion in Robinhood enhancing its accessibility and Filecoin's strategic upgrades solidifying its market position, the future looks promising for these projects. Web3Bay, in particular, stands out as a compelling opportunity for investors seeking to engage with a robust, growth-oriented crypto initiative in the decentralized commerce space.

9 months ago

Beamable Shines at GDC 2025: A New Era for Decentralized Gaming

Beamable made a significant impact at GDC 2025, showcasing its commitment to decentralized gaming and innovative infrastructure. The event kicked off with an exclusive brunch that gathered industry leaders from major firms like A16z, Binance, and Meta. This gathering was not just a social event; it served as a platform for discussing the future of decentralized gaming and how Beamable's infrastructure can empower developers to create scalable and successful games. The atmosphere was charged with excitement as insights were exchanged, setting the stage for fruitful collaborations.

Throughout the conference, Beamable's leadership took center stage at various summits, including the Beamable x Solana Developer Summit. CEO Jon Radoff and CTO Ali El Rhermoul presented on the advantages of decentralized infrastructure for live game operations, emphasizing how it can mitigate backend risks and enhance cost efficiency. Additionally, COO Trapper Markelz engaged developers with real-time demos at the Sui Gaming Summit, focusing on Web3 monetization strategies. These sessions highlighted the importance of adopting Web3-native solutions in today's gaming landscape.

The networking opportunities at GDC 2025 were unparalleled, with Beamable hosting a lively happy hour that attracted a diverse crowd of developers and founders. The event fostered discussions about game development and backend tools, solidifying Beamable's role as a key player in the industry. With numerous meetings held throughout the week, Beamable connected with various studios and publishers, addressing their technical challenges and exploring partnership opportunities. As GDC 2025 concluded, Beamable remains committed to driving innovation in decentralized gaming and looks forward to continuing these conversations beyond the event.

9 months ago

Solana's Remarkable Rebound: Price Surge and Ecosystem Developments

In the past week, Solana has experienced a significant rebound, with its price surging 12% to reach $140. This uptick in value comes amid renewed market optimism, spurred by the Trump administration's softened stance on tariff negotiations and the U.S. Federal Reserve's decision to maintain interest rates. The total value locked (TVL) in Solana's ecosystem has also risen to an impressive $72 billion, reflecting growing confidence among investors. Notably, Solana's stablecoin supply has hit record levels, surpassing $12.8 billion, indicating robust liquidity and adoption within the network.

In ecosystem developments, Pump.fun has launched its decentralized exchange (DEX), PumpSwap, which aims to streamline trading for Solana meme coins. This move has prompted Raydium to introduce LaunchLab, a platform designed to compete with Pump.fun and retain its market share. Additionally, Volatility Shares has debuted two funds tracking Solana futures, SOLZ and SOLT, providing investors with new avenues for exposure to the layer-1 network. As institutional interest grows, Fidelity has registered the "Fidelity Solana Fund," potentially paving the way for a Solana ETF, which could further enhance market dynamics.

Despite the positive trends, Solana's decentralized exchange volume has seen a decline, dropping 20% to $8.06 billion. However, the overall market sentiment remains bullish, with Solana outperforming its rivals, including Ethereum and Bitcoin. The ecosystem's market cap has increased by 10%, and daily active addresses have risen to over 3.8 million. As Solana continues to innovate and attract attention, the coming weeks will be crucial in determining its trajectory in the competitive blockchain landscape.

9 months ago

Solana DePIN Sees Significant Growth Amidst Meme-Coin Decline

In February, the decentralized physical infrastructure network (DePIN) associated with Solana [SOL] experienced a notable rebound, driven by significant user growth in key projects such as Helium and Hivemapper. Helium Mobile reported a remarkable ninefold increase in users, reaching 145,000, marking its highest growth in a year. Hivemapper, a community-driven alternative to Google Maps, also saw its demand triple due to the introduction of new mapping devices. Collectively, these projects maintained steady revenues of approximately $350,000, indicating a stabilization in the DePIN sector for 2025.

The resurgence of DePIN could potentially serve as a catalyst for SOL's value, especially following a significant decline in meme-coin activity that adversely affected Solana's decentralized exchange (DEX) volumes. In January, during the peak of DEX activity, SOL reached a record high of $295, largely fueled by the excitement surrounding the TRUMP memecoin. However, a subsequent 60% drop in DEX volumes led to a decline in SOL's value, which has since stabilized above the $120 support level. The question remains whether DePIN can fill the void left by meme coins and bolster SOL's value moving forward.

Despite the resurgence of DePIN, the overall network activity within the Solana ecosystem remains heavily influenced by meme coins. Active addresses surged to 5.7 million during the TRUMP meme-coin craze in mid-January but saw a decline throughout February. Although there was a slight increase in active addresses to 4.4 million, this was followed by a drop to 2.7 million by the end of the month. By mid-March, the number of active addresses stabilized at 3.11 million, reflecting a 45% decrease from January's peak. As of now, SOL is valued at $130, maintaining its position above the critical 2024 support zone, leaving uncertainty about whether it can avoid further corrections.

9 months ago

Helium Network Expands Despite Token Decline and Past Controversies

In the fourth quarter, Helium's native token, HNT, experienced a significant decline, with its circulating market capitalization dropping from $1.3 billion to $1.0 billion, marking a 20% quarter-over-quarter decrease. The token's price also fell by 22%, decreasing from $7.54 to $5.88. Despite this downturn in the market, the Helium network continued to expand, particularly in the area of hotspot adoption. According to a report from Messari, Helium Mobile's number of hotspots grew by 14% QoQ, reaching 24,800 from 21,800. The service's unlimited plans remain competitively priced compared to traditional telecom providers in the US, and the introduction of the Discovery Mapping feature has incentivized users to share location data, although rewards have recently shifted from HNT to Cloud Points.

During the recent Hurricane Helene in North Carolina, Helium Mobile showcased its utility by maintaining operational hotspots that provided 5G coverage while many were left without electricity or water. The team also took proactive measures by distributing emergency kits, including Starlink devices, to assist affected communities. In addition to Helium Mobile, the IoT network also saw a 20% increase in hotspots during Q4, with a total of over 375,000 hotspots onboarded since migrating to Solana in early 2023. However, despite rapid infrastructure growth, demand has not yet caught up, as evidenced by low daily data credits (DC) usage.

Helium has faced controversies in the past, including allegations that its founders hoarded a significant portion of early token rewards, with insiders reportedly mining millions of HNT tokens worth $250 million at their peak. Additionally, Helium faced criticism for overstating partnerships, such as with Lime, the rideshare company, which clarified that their relationship was limited to a 2019 test. Similar issues arose with Salesforce, which denied any partnership, leading Helium to remove their logos from promotional materials. These controversies have raised questions about the company's transparency and the sustainability of its growth strategies.

9 months ago

Nubila Launches Dual Mining Campaign for $IOTX with Marco Weather Stations

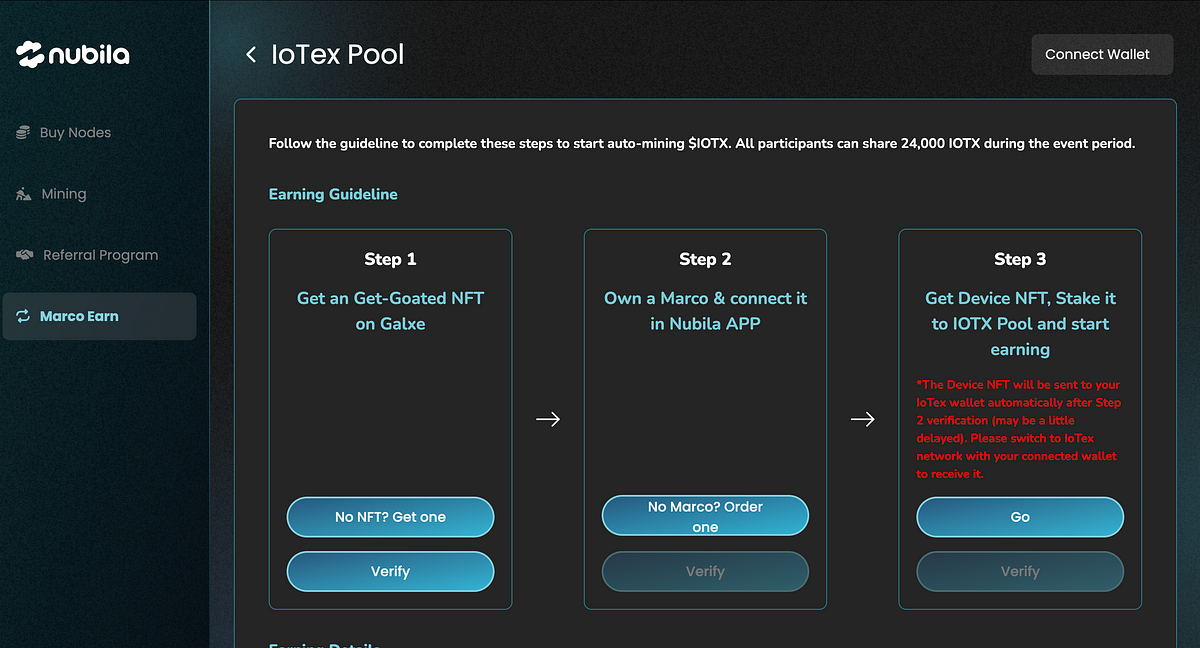

Nubila is at the forefront of a decentralized initiative aimed at collecting and rewarding real-time environmental data through its innovative Marco Weather Station, aligning with the broader DePIN movement. Participants in Nubila's Get Goated Season 2 campaign who own a Marco device can now engage in a Dual Mining Campaign. This program enables users to mine $IOTX, the native token of the IoTeX ecosystem, while also accumulating Nubila Mining Points, thereby incentivizing the collection of valuable environmental data.

To participate in the Dual Mining Campaign, users must meet specific eligibility requirements. Firstly, they need to own a Marco Weather Station and have it linked to the Nubila app, as the data collected from this device is essential for the mining process. Additionally, claiming the Nubila Get Goated Season 2 NFT, distributed via Galxe, is mandatory as it serves as an access pass for the dual mining activities. Once these prerequisites are fulfilled, participants can proceed to connect their wallets and verify their email addresses to confirm their ownership of the Marco device.

After verification, users can stake their Marco NFT in the IoTeX reward pool to activate dual mining. The process is designed to be user-friendly, with no gas fees required for transactions on the IoTeX interface. Nubila aims to create a decentralized environmental data network, utilizing AI to deliver accurate insights for industries sensitive to weather changes. This initiative not only promotes climate change awareness but also encourages sustainability through incentivized IoT devices, paving the way for a more informed and responsive approach to environmental challenges.

9 months ago

DIMO Developer Ecosystem Blooms with New Features and Updates

Spring has arrived, bringing a wave of innovation to the DIMO Developer ecosystem. With over 250 developer licenses minted, the platform is witnessing a surge in app launches and builder updates. Recent enhancements to the Data SDKs, including new functions for retrieving vehicle data and streamlined token exchanges, aim to simplify the development process. The naming conventions have also been updated for clarity, making it easier for developers to access privileged vehicle data without excessive boilerplate code.

In an exciting development, DIMO has officially begun support for Tesla Streaming as of March 1st. This feature allows developers to access real-time data from Tesla vehicles down to the second, a significant improvement from the previous five-minute interval data. However, it's important for developers to note that this feature is only available to Tesla drivers who have reconnected their vehicles with the DIMO mobile app and added a Virtual Key. This update opens new avenues for applications that require immediate and detailed data from Tesla vehicles.

Additionally, the DIMO Developer Console is set to undergo significant changes, including the consolidation of multiple apps under individual developer licenses. This update will streamline the user experience, allowing developers to manage their applications more efficiently. Furthermore, a redesign of the Developer Console is on the horizon, featuring an improved onboarding experience, a cleaner purchase process, and new integration options. These enhancements are designed to foster a more supportive environment for builders, ensuring they have the tools they need to succeed in their projects. Developers are encouraged to engage with the community and explore funding opportunities through the DIMO Ignite Grants Program as they embark on their building journeys.

9 months ago

Roam: Pioneering the DePIN Track in Web3 Integration

In 2025, the DePIN track is emerging as a vital link between Web3 and real-world applications. According to the "DePIN Annual Report" by Messari, over 13 million DePIN devices are currently operational globally, contributing to infrastructure networks. Despite being in its infancy and representing less than 0.1% of the trillion-dollar terminal market, DePIN has attracted more than $350 million in early funding. As the on-chain battle intensifies in 2024, Solana is leading the charge in network infrastructure, while ROAM has gained significant traction with nearly 3 million WiFi nodes and 2.5 million users, showcasing its rapid growth and community engagement.

Roam's impressive expansion is attributed to its integration of OpenRoaming technology and blockchain DID/VC technology, alongside a business model that combines free eSIM services with token incentives. This approach not only broadens its wireless network reach but also facilitates user entry into the Web3 ecosystem, offering continuous income opportunities. The recent launch of the ROAM token on 12 exchanges, including Bybit and Bitget, saw a remarkable trading volume of $120 million on its first day, establishing it as a leader in decentralized wireless networks. Roam's unique dual deflationary economic model further enhances its revenue potential, shifting focus from supply-side growth to demand-side exploration.

Looking ahead, Roam is poised to solidify its position in the DePIN track through innovative applications and robust token economics. The upcoming use cases for ROAM tokens in gaming centers and credit card transactions will enhance user engagement and token consumption. With a total supply of 1 billion tokens and a strategic dual deflationary mechanism, Roam aims to create scarcity and drive long-term value. As it continues to expand its global open wireless network, Roam exemplifies the potential of decentralized technologies in shaping the future of connectivity and AI development, warranting close attention from the blockchain community.

9 months ago

New Jersey Devils Launch AI Chatbot 'Bott Stevens' for Enhanced Fan Engagement

The New Jersey Devils have introduced a groundbreaking AI chatbot named "Bott Stevens," aimed at enhancing digital fan engagement. This innovative chatbot is named after the legendary Devils player Scott Stevens and is powered by Theta EdgeCloud's decentralized AI infrastructure. Scheduled to launch during the 2024-25 NHL season, Bott Stevens will be accessible on the team's official website, providing fans with real-time information on game schedules, ticket sales, statistics, and merchandise. Utilizing Theta's Retrieval Augmented Generation technology, the chatbot will ensure data accuracy by sourcing information from official NHL channels, thereby minimizing the risk of misinformation from unverified sources.

Bott Stevens boasts impressive computational capabilities, leveraging Theta EdgeCloud's network of over 30,000 edge nodes and distributed GPUs, which collectively offer more than 80 PetaFLOPS of processing power. This robust infrastructure is designed to handle peak demand, particularly during high-stakes events like playoffs or significant team announcements. In addition to answering fan inquiries, the chatbot will provide historical highlights, game recaps, venue information, and updates on team events. Future enhancements may include predictive analytics for fantasy sports and interactive tools to further engage fans.

To promote Bott Stevens, the Devils plan to integrate its capabilities across multiple platforms, encouraging fan interaction and awareness. The chatbot will not only deliver statistics and schedules but also curated content that enriches the fan experience, such as historical highlights and information about upcoming events. Success metrics will include user engagement rates, accuracy of information, and feedback from fans, ensuring that Bott Stevens remains a valuable resource for the Devils' community. By focusing on continuous learning and personalized interactions, the team aims to differentiate Bott Stevens from other AI agents, creating a unique and engaging experience for fans.

Signup for latest DePIN news and updates