Deeper

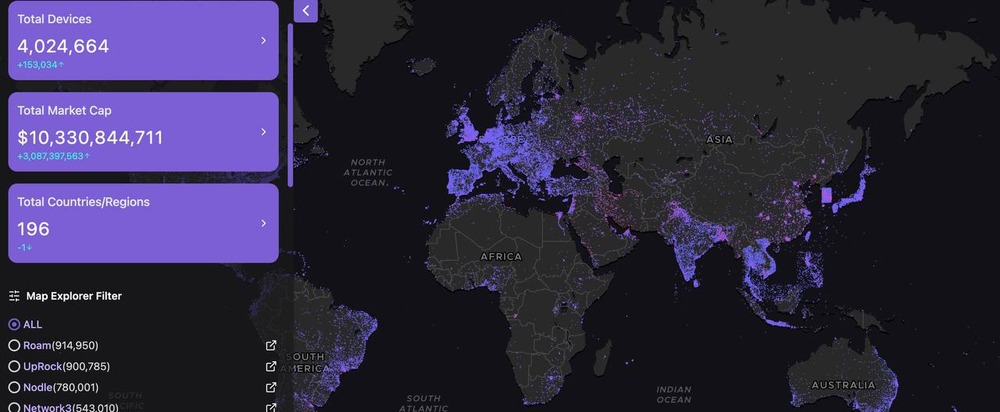

The Deeper Network is a web3 infrastructure project focused on security, privacy and internet freedom. Built on Substrate, Deeper has hardware which provides decentralized VPN services, cyber-security as well as a sharing economy which incentivizes users to contribute their unused bandwidth and IP to accomplish web3 tasks initiated by Dapps built on the native Deeper Chain. Currently, there are over 100,000+ decentralized nodes all over the world contributing to the network.

DPR

The average device cost is $180.08, and the estimated daily earnings are $0.04.At this rate, the break-even point will be reached in 4502 days.

Chart

Minable Devices

DPR Markets

Exchange | Pair | Price | Spread | +2% Depth | -2% Depth | 24h Volume | Volume % | Last Updated | Trust Score |

|---|---|---|---|---|---|---|---|---|---|

KuCoin | DPR/USDT | $0.0001466 | 1.01626% | $370.957 | $148.469 | $52,147 | 0.000% | 6 hours ago | |

Gate | DPR/USDT | $0.0001494 | 0.133779% | $626.836 | $720.177 | $13,488 | 94.907% | 6 hours ago | |

PancakeSwap (v2) | DPR/BSC-USD | $0.0001480 | 0.638676% | $224.009 | $223.336 | $569 | 3.967% | 6 hours ago | |

PancakeSwap (v2) | DPR/WBNB | $0.0001480 | 0.87226% | $29.916 | $29.827 | $53 | 0.366% | 6 hours ago | |

PancakeSwap (v2) | DPR/BUSD | $0.0001480 | 0.974164% | $21.684 | $21.619 | $27 | 0.187% | 6 hours ago | |

Uniswap V4 (Ethereum) | DPR/DPR | $0.0001497 | 0.613899% | $662.745 | $660.754 | $446 | 0.000% | 6 hours ago | |

Uniswap V2 (Ethereum) | DPR/USDC | $0.0001492 | 0.697154% | $85.107 | $84.851 | $59 | 0.404% | 6 hours ago | |

LATOKEN | DPR/USDT | $0.0001499 | 71.153846% | - | - | $24 | 0.167% | 6 hours ago |

Learn More

The Deeper Network is a web3 infrastructure project focused on security, privacy and internet freedom. Built on Substrate, Deeper has hardware which provides decentralized VPN services, cyber-security as well as a sharing economy which incentivizes users to contribute their unused bandwidth and IP to accomplish web3 tasks initiated by Dapps built on the native Deeper Chain. Currently, there are over 100,000+ decentralized nodes all over the world contributing to the network.

Deeper News

View more

Social

Impressions

109,467

Engagement

2,211

Mindshare

0.02%