Latest Hivemapper News

a year ago

Edge AI Revolutionizing Data Processing at the Edge

375ai Revolutionizing Data Processing at the Edge

As the world becomes increasingly interconnected through millions of smart devices, the demand for rapid data processing at the edge—right where the data is generated—is greater than ever. Edge AI enables intelligence where data is generated, on highways, bustling streets, in hospitals, and retail stores. It operates at the network's edge, making sense of the unstructured, real-time data that represents our world. 375ai has been at the forefront of Edge AI innovation, leveraging cutting edge proprietary hardware and strategic partnerships to pioneer the world’s first decentralized edge data intelligence network. After years of development, we’re thrilled to announce the launch of the 375go Discovery Testnet.

Why Edge AI and Why Now?

Edge AI deploys artificial intelligence on devices throughout the physical world, bypassing the need for centralized cloud processing. Recent advancements in AI, Internet of Things (IoT) devices, and computing infrastructure make edge AI not just possible but essential. The benefits include: Real-time Decision-Making, Increased Privacy, Reduced Costs, Adaptability, and Resilience. The explosive growth of IoT devices has resulted in a deluge of data—from a wide variety of sensors to mobile phones and traffic cameras. Instead of sending all this data back to centralized servers for analysis, edge AI makes it possible to process and act on that data locally. This results in lower costs, faster response times, enhanced privacy, and even autonomy in the absence of internet connectivity.

a year ago

Hivemapper Launches HONEY-JitoSOL Liquidity Incentive Program with Strategic Partners

The Hivemapper Foundation has recently formed a strategic partnership with Kamino and Jito Labs to launch the HONEY-JitoSOL liquidity treasury incentive plan. This initiative comes at a time when many investors in the cryptocurrency market are still engaged in zero-sum games, while decentralized physical infrastructure networks (DePIN) are paving new avenues for value creation. The rapid advancement of Web3 technology is facilitating a deep integration of DePIN and decentralized finance (DeFi), which is reshaping the blockchain industry's landscape. This integration promises to enhance the liquidity of physical assets and foster substantial innovation across the blockchain ecosystem.

Hivemapper, a decentralized mapping network operating on the Solana blockchain, has made significant strides since its inception in November 2022, mapping 29% of the world’s roads within two years. Utilizing innovative “Bee” dashcam devices and AI technology, Hivemapper captures over 28 million kilometers of street-level imagery monthly, outpacing Google Street View by five times. The project has garnered investments from notable institutions, including A16Z and Binance, and has established partnerships with global mapping giants. The HONEY token incentivizes user participation in data collection, addressing challenges in developing high-precision maps through a unique AI+DePIN model.

The newly launched liquidity solution on the Orca trading platform offers up to $17,000 in rewards for HONEY token liquidity providers. It features automated transaction fee income, smart rebalancing, and professional analysis tools to help users navigate risks. The market response has been overwhelmingly positive, with the HONEY-JITOSOL liquidity pool achieving a Boosted APY of 36.02% and a total value locked (TVL) exceeding $500,000 shortly after launch. This innovative cooperation not only highlights the potential of integrating DePIN with DeFi but also sets a precedent for future developments in the blockchain space, demonstrating how decentralized finance can empower the real economy and create new opportunities for users.

a year ago

Hivemapper Network Proposes Increase in Map Credit Prices to Enhance Value Accrual

Hivemapper Network has announced a proposal to increase the price of map credits from $0.005 to $0.0075, effective January 1, 2025. This adjustment is part of a strategy to stabilize the price of map data for end customers while ensuring that the value accrued from customer spending benefits the Hivemapper Network. Map Credits, which are generated by burning HONEY, play a crucial role in this ecosystem, as developers must redeem them to access network data. The proposed increase aims to enhance the deflationary trajectory of HONEY by allowing a greater share of revenue to flow back into the network, thereby supporting its long-term sustainability.

The Hivemapper Network operates on a Burn and Mint model, where map contributors earn HONEY for submitting data, while developers burn HONEY to access this data. This system is designed to balance supply and demand effectively. By raising the price of map credits, the network anticipates that developers will still find it viable to build value-added products, as the increased costs will be offset by the potential for higher profit margins. The leadership at Bee Maps, the first developer on the network, has expressed confidence that this price adjustment will not adversely affect network usage, indicating a manageable margin compression.

Community engagement is encouraged as the proposal moves forward. Members of the Hivemapper community are invited to share their thoughts and feedback during a comment period from November 26 to December 2, 2024. The Hivemapper Foundation emphasizes the importance of collaboration in refining the network's design to achieve the goal of creating the world’s freshest map. This proposal reflects a commitment to both developer incentives and the overall health of the Hivemapper ecosystem.

a year ago

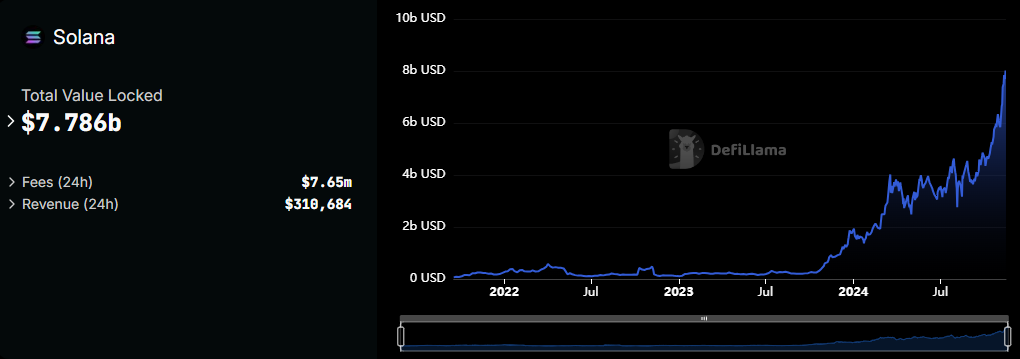

Solana Surges to 111% of Ethereum's Economic Value Amid DeFi Growth

In October, Solana's real economic value (REV) reached an impressive 111% of Ethereum's, driven by significant growth in decentralized finance (DeFi) and innovative projects such as Hivemapper and Helium. The price of Solana (SOL) surged by 36% recently, hitting $213, but it now faces a crucial challenge at the $221 resistance level. Despite strong network activity and a notable increase in staking, concerns linger about the sustainability of this momentum. The decentralized exchange (DEX) volumes have also seen a remarkable rise, with daily trading exceeding $5 billion for three consecutive days last week, totaling $16 billion from November 10 to 15, primarily driven by Raydium and Orca.

Staking activity has emerged as a key factor in bolstering investor confidence, with over $8 billion worth of SOL staked, which helps alleviate selling pressure and enhances price stability. This represents one of Solana's strongest metrics during its current rally. Technical indicators support a positive outlook, as the average directional index (ADX) for SOL stands at 32, indicating a strong trend. However, the inability to breach the $221 barrier could result in a price range between $201 and $221 in the short term, with potential pullbacks signaling a reversal of the bullish trend.

Solana's DeFi ecosystem continues to thrive, with meme coin trading contributing to a daily volume of $1 billion, showcasing its growing appeal among retail traders. The network's impact extends beyond DeFi, with projects like Hivemapper mapping a significant portion of global roads and Helium expanding its device network. With robust staking, increasing transaction volumes, and strong technical indicators, Solana is poised for further growth. However, breaking the $221 resistance is critical for unlocking greater potential, with medium-term targets projected between $400 and $500, supported by a bullish cup-and-handle formation on its chart.

a year ago

Hivemapper Proposes Liquidity Vault to Enhance On-Chain Liquidity

On-chain liquidity is essential for the effective trading of tokens on decentralized exchanges (DEXs). The recent launch of the Hivemapper Network has led to the organic formation of on-chain liquidity around its token, HONEY. This proposal aims to allocate up to 750,000 HONEY as a promotional incentive for a user-friendly "liquidity vault" that would enhance on-chain liquidity. By increasing liquidity, the Hivemapper Network can reduce price volatility and foster greater confidence in the HONEY economy, ultimately supporting its overall health and efficiency.

The mechanics of DEX trading rely on liquidity pools created by individual users who contribute tokens to facilitate trades. Currently, HONEY has around $450,000 in on-chain liquidity, primarily on Solana's Orca DEX. In contrast, other decentralized physical infrastructure tokens on Solana boast over $3 million in liquidity, highlighting the need for HONEY to bolster its liquidity to avoid excessive volatility and inefficiencies in the market. Liquidity providers earn fees based on their contributions, but they also face risks such as impermanent loss, which can deter participation. To counteract this, some projects offer incentives comparable to staking yields to encourage liquidity provision.

The proposed liquidity vault will be an experimental program lasting a minimum of three months, with rewards for liquidity providers varying based on their contributions. If approved, the vault is expected to launch in November, in collaboration with partners from the Solana ecosystem. Educational sessions will be held to inform community members about the benefits and risks of participating in the liquidity vault. The Hivemapper community is invited to engage in discussions and provide feedback on this proposal to ensure the network continues to evolve effectively toward its goal of creating the world's freshest map.

a year ago

Hivemapper Celebrates Two Years of Innovation and Growth

As the Hivemapper Network celebrates its second anniversary, it reflects on a remarkable year of growth and innovation. Launched two years ago, Hivemapper has become the fastest-growing mapping project globally, achieving an impressive 28% coverage of the world's roads—five times faster than Google Street View. Despite facing hardware shortages, the network has outpaced other crowdsourced mapping initiatives, attracting significant interest from major mapmakers and industries such as automotive and logistics. The rising demand has resulted in over 6 million HONEY tokens burned, showcasing the project's increasing utility and adoption.

The integration of AI into the mapping process has been another highlight, with Hivemapper's AI Trainer pipeline evolving into a robust data generation and validation system. This initiative has garnered attention from investors, who see the potential for AI Trainers as a standalone service. Marketing efforts have positioned Hivemapper at the forefront of Decentralized Physical Infrastructure (DePIN), with endorsements from notable entities like A16Z and Binance. The liquidity of HONEY tokens has improved significantly, with listings on major exchanges and a remarkable 50-fold increase in market cap since the project's inception, despite the challenges posed by a volatile crypto market.

Looking ahead, Hivemapper's roadmap for Year 3 is ambitious. The focus will be on expanding the HONEY economy, increasing map coverage, and enhancing customer engagement. Plans include launching next-generation dashcams, refining tokenomics, and fostering a developer ecosystem through grants and APIs. The network aims to innovate in consumer navigation and fleet intelligence while ensuring transparency and decentralization. As Hivemapper continues to evolve, it remains committed to its vision of a community-driven mapping future, encouraging contributions that will shape the landscape of geospatial services for years to come.

a year ago

Solana's Innovations Overlooked in EVM-Biased Report

In a recent analysis of a16z's report on the "State of the Crypto Industry," Lily Liu, Chair of the Solana Foundation, highlights a notable EVM bias that overlooks Solana's impressive achievements in transaction fees, NFTs, and the DeFi market. Despite Solana leading in NFT addresses and transaction volume over the past year, the report fails to acknowledge significant innovations in decentralized physical infrastructure networks (DePIN), such as Helium and Hivemapper, which thrive within the Solana ecosystem. Liu argues that the report's binary framework, which positions EVM and non-EVM ecosystems as oppositional, misrepresents the true landscape of blockchain development and user engagement.

Liu emphasizes the importance of transaction fees as a more meaningful metric for assessing ecosystem activity and health, rather than relying solely on active addresses or Total Value Locked (TVL). Since introducing a fee market, Solana's transaction fee market share has surged from below 1.5% to consistently above 10%, peaking at 25% in July 2024. This shift indicates a growing economic value within the Solana ecosystem, narrowing the gap with Ethereum when considering Real Economic Value (REV). Furthermore, Liu critiques the report's gaming sector analysis, which fails to adequately include non-EVM networks like Solana, leading to incomplete comparisons that do not reflect the full blockchain gaming ecosystem.

Additionally, Liu points out that the report's focus on TVL for DeFi comparisons is insufficient, as it overlooks critical metrics such as transaction volume. While Solana's TVL is only 10% of Ethereum's, its monthly DEX transaction volume often exceeds that of Ethereum, highlighting its capital efficiency. Liu also notes that Solana's low transaction costs have driven significant consumer behavior changes, exemplified by the success of platforms like Drip Haus. The absence of DePIN innovations within the report raises questions about its comprehensiveness, as groundbreaking projects like Helium and Hivemapper are primarily developing within the Solana ecosystem, showcasing the real-world applications of decentralized networks.

a year ago

DePin: The Future of Blockchain in Real-World Applications

The emergence of Decentralized Physical Infrastructure Networks (DePin) is addressing a critical question in the cryptocurrency space: what practical applications does blockchain technology offer? DePin represents a shift towards utilizing blockchain for solving real-world issues, moving beyond speculative tokens. Projects under DePin, such as Hivemapper, Helium, and GEODNET, are leading the charge by leveraging blockchain to create innovative solutions that can be easily understood and utilized by the general public.

Hivemapper is revolutionizing mapping technology by allowing users to contribute to a live, high-definition map of the world. Users can purchase a 4K dashcam that maps roads as they drive, earning HONEY tokens in the process. In less than two years, Hivemapper has mapped over 330 million kilometers of roads, significantly outpacing traditional mapping services like Google Maps. Meanwhile, Helium has established a global IoT network by selling mini cell towers, allowing individuals to earn HNT tokens for providing internet coverage. With over one million hotspots deployed, Helium is also expanding into mobile services, demonstrating the scalability of its decentralized model.

Another noteworthy project, GEODNET, aims to enhance GPS accuracy by utilizing a network of satellite miners installed on rooftops. This innovative approach offers centimeter-level precision at a fraction of the cost of traditional GPS services. GEODNET's partnership with the US Department of Agriculture highlights its potential applications in sectors where precision is crucial, such as agriculture. Overall, DePin projects are not only showcasing the transformative power of blockchain technology but are also poised to lead the next wave of growth in the cryptocurrency market, making it an exciting sector to watch in the coming years.

a year ago

Revolutionizing Crypto: DePIN Projects Hivemapper and Helium Leading the Way in Real-World Innovation

Decentralized physical infrastructure (DePIN) projects like Hivemapper and Helium are gaining attention in the crypto world. These projects are revolutionizing real-world problems by incentivizing users with tokens to contribute to infrastructure development. Unlike many 'hometown heroes' in the crypto space, DePIN projects are aiming for mass market adoption, making them stand out in the industry. Hivemapper rewards users for video-mapping local streets, while Helium pays individuals to share their 5G internet bandwidth, potentially making mobile service cost-free for some. By utilizing blockchain technology to solve real-world challenges, these projects are setting a new standard for innovation in the crypto sphere. This approach has led to positive growth in the DePIN sector, highlighting the potential for blockchain to address global infrastructure needs.

a year ago

Revolutionizing Location Monitoring with Scout's Street Imagery

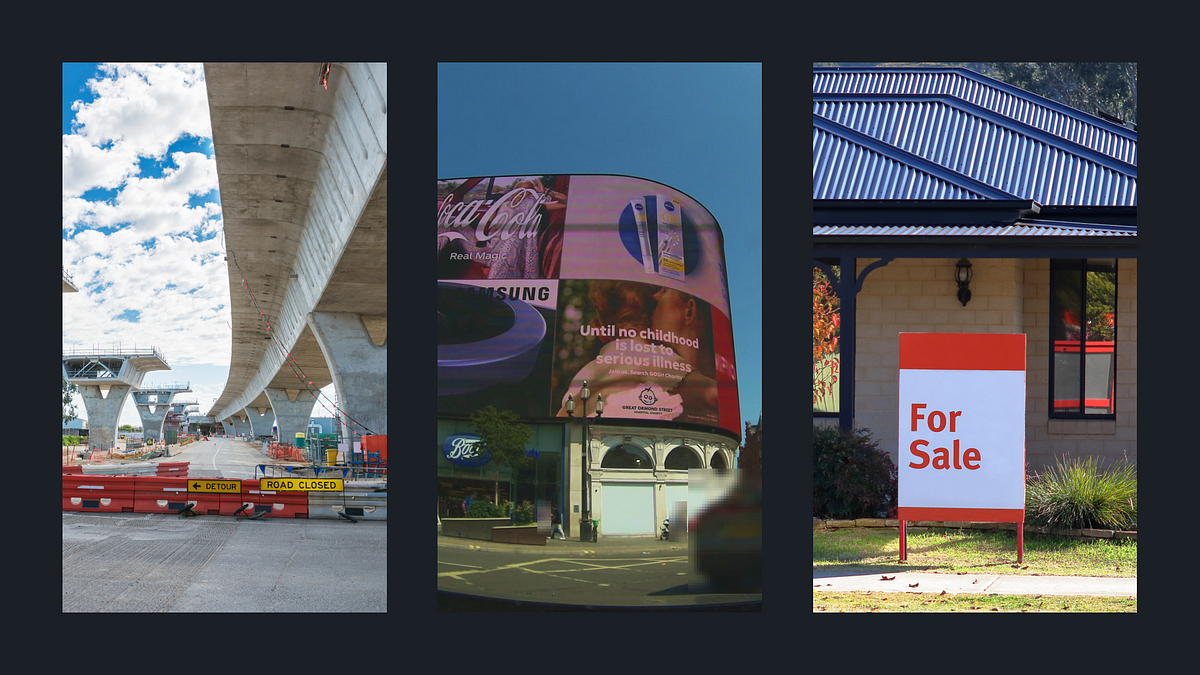

Scout: Revolutionizing Location Monitoring with Street Imagery

In a world where change is constant, having up-to-date, accurate information is crucial for staying ahead. Scout, our next-gen self-service location monitoring tool, provides on-demand street imagery for various scenarios. Whether you're a real estate agent, an advertising agency, or a municipal employee, Scout offers a boots-on-the-ground view of any location, saving time and resources. Ad agencies can now monitor billboard trends in real-time, ensuring their campaigns are eye-catching and relevant. With Hivemapper Scout, advertisers can stay ahead of cultural shifts and make informed decisions on ad placements. Contact sales@hivemapper.com to learn more about how Scout can support your business needs!

Signup for latest DePIN news and updates