Latest DePIN News

10 months ago

Network3 Launches Decentralized Edge AI Infrastructure with $N3 Token

Network3 is revolutionizing the decentralized Edge AI landscape by providing a robust infrastructure that empowers AI developers worldwide. This innovative platform leverages advanced technologies such as AI model optimization, federated learning, edge computing, and confidential computing to facilitate rapid and efficient model inference, training, and validation at scale. By moving beyond the constraints of centralized AI systems, Network3 is committed to creating a more equitable, efficient, and democratic AI ecosystem that benefits all stakeholders involved.

Built on the IoTeX blockchain, Network3 utilizes IoTeX's DePIN modular infrastructure, which includes ioID and data verification modules, to ensure secure and transparent decentralized applications. This integration not only enhances the reliability of data exchange but also supports the growth of the DePIN ecosystem. Additionally, the introduction of the N3 Edge V1 mining machine allows participants to engage in $IOTX dual-mining, thereby expanding the network's global node user base. This collaboration with IoTeX provides a scalable and secure Edge AI solution, enabling developers to innovate confidently while maintaining data integrity.

The highly anticipated $N3 token will be launched on January 22 at 8:00 AM (UTC) during its Token Generation Event (TGE). The smart contract for the $N3 token will be deployed on Ethereum, with simultaneous launches on IoTeX and Solana chains to enhance accessibility and scalability. This multi-chain strategy promotes interoperability, allowing users from different ecosystems to connect and contribute to Network3's growth. To celebrate this launch, Network3 is also conducting a community airdrop of 50 million $N3 tokens, aimed at rewarding early supporters and encouraging active participation within the ecosystem.

10 months ago

Countdown to $CHIRP Token Launch and Reward Distribution

The countdown to the official launch of the $CHIRP token is on, with January 20, 2025, marking a pivotal moment for the Chirp ecosystem. This event will not only see the token listed on centralized exchanges (CEXs) but will also initiate the distribution of rewards to the community. A total reward pool of 1.73% of the total supply has been allocated for pre-mainnet marketing campaigns, acknowledging the unwavering support from community members, including those engaged in CHIRP mining activities and the dedicated Keepers. Notably, 1,000,000 CHIRP tokens will be distributed to Keepers who have maintained their Blackbird miners in good standing prior to the mainnet launch, with eligibility linked to holding Nest NFTs.

In addition to the rewards for Keepers, the Kage mining community will also be recognized for their contributions. The top 45,000 Data Hunters, who have amassed the highest number of Data Chips and connected their Sui wallets to their Kage profiles, will share a prize pool of 2,000,000 CHIRP tokens. The snapshot for this leaderboard will be taken on January 20 at 12:00 CET, and players engaging in negative behaviors, such as spoofing or spreading misinformation, will be excluded from the rewards. This initiative aims to foster a fair and competitive environment within the Kage ecosystem.

Moreover, Chirp is set to reward participants from various marketing campaigns with a total of 1,630,000 CHIRP tokens. Winners from campaigns like Zealy and the Chirp Tracker App will receive their rewards on January 20, 2025, provided they have connected and verified their Sui wallets. As Chirp continues to build a future where blockchain technology enhances IoT and geolocation solutions, the community is encouraged to engage actively and contribute to this transformative journey.

10 months ago

Decentralized Edge AI Platform Network3 to Launch $N3 Token Trading

Decentralized Edge AI Platform Network3 to Launch $N3 Token Trading on Bybit, Gate.io, and BingX

According to official sources, the decentralized Edge AI infrastructure platform Network3 will simultaneously launch spot trading of the token $N3 on Bybit, Gate.io, and BingX exchanges on January 22, 2025, at 8:00 (UTC). This milestone event signifies a crucial step for Network3 in realizing the value of user Edge Data and computing power, injecting strong momentum into the ecosystem's development and expansion.

Network3 is currently conducting a Pre-TGE airdrop activity, rewarding the community with 50 million tokens. Users simply need to log in to the official Network3 website and complete specified tasks to receive a free airdrop quota worth 40,000 points, which can be exchanged for $N3 after TGE. Additionally, the activity offers NFT acceleration cards to help users enhance node mining efficiency.

In July 23, 2024, Network3 successfully completed a $5.5 million pre-seed & seed round of financing, with investors including Borderless, EV3 Labs, loTeX, SNZ, Bing Ventures, Waterdrip Capital, Web3Port Foundation, and other well-known venture capital institutions.

10 months ago

Funding

NodeOps, a decentralized node-as-a-service (NaaS) platform, achieved $2.5M in revenue in 2024, managed $63.3M in assets, and demonstrated an impressive CAGR of 350% over the last six months. According to the figures released in the latest Messari State of DePIN report, this places NodeOps as one of the top 10 projects in the DePIN space.

Raised $5M from L1D, Finality Capital, BFF and angels such as Sandeep (Polygon), JD Kanani (Polygon), Rushi (Movement), Sunil Sharma (Circle) and Richard (Quantstamp) with participation from, BitScale Capital, Double Peak Group

[https://finance.yahoo.com/news/nodeops-secures-top-spot-among-133300369.html?guccounter=2]

10 months ago

Chirp Project: A Decentralized Solution for IoT Connectivity

In the rapidly evolving Internet of Things (IoT) landscape, the emergence of various connectivity standards has led to significant fragmentation, complicating the integration of IoT devices into cohesive networks. To address this challenge, the Chirp project has introduced a decentralized physical infrastructure network (DePIN) designed to enhance the connectivity and management of IoT devices. Chirp operates on a mesh network architecture utilizing LoRa and Sub-GHz LoRaWAN radio communication, supported by a comprehensive ecosystem known as Chirp Wireless. This ecosystem is tailored to power decentralized sensors, robotics, and other IoT devices, with hardware gateways called Blackbirds maintained by a decentralized community known as the Keepers.

The Blackbird devices play a crucial role in providing network coverage through multiple connection protocols, including 2.4 GHz LoRa, Sub-GHz LoRaWAN, Zigbee, Bluetooth Low Energy (BLE), and Thread. This versatility makes Chirp suitable for both residential and commercial applications, facilitating both high-bandwidth close-range communication and sparse long-range connectivity. Keepers are incentivized with CHIRP tokens for their contributions to maintaining the network infrastructure. Notably, Chirp differentiates itself from other platforms, such as Helium, by having a single licensed manufacturer for its nodes, which helps manage supply and maintain appropriate reward levels, thus preventing network oversaturation.

The CHIRP token is integral to the Chirp ecosystem, serving multiple purposes, including rewarding Keepers, granting access to the network, and managing governance processes. Users can connect devices through various subscription models, with payments made in CHIRP tokens on the Sui blockchain. With a total supply capped at 300 million tokens, the distribution is planned over the first ten years post-token generation event (TGE). While Chirp presents a promising solution to unify the fragmented IoT sector, its current stage, with approximately 400 active nodes and limited commercial clients, highlights the need for stable revenue generation to ensure ongoing network participation. The future of Chirp hinges on its ability to attract commercial users who can provide consistent demand for its services.

10 months ago

Network3 AI to Launch N3 on IoTeX Platform

On January 22, 2025, Network3 AI is set to launch its new product, N3, on the IoTeX platform. This innovative offering combines decentralized AI access with advanced technology, marking a significant step in the integration of decentralized physical infrastructure networks (DePIN) and artificial intelligence (AI). The launch is expected to attract tech enthusiasts to the IOTX ecosystem, potentially driving up adoption rates and influencing the token's price positively if the community responds favorably.

The introduction of N3 is not just a technological advancement; it represents a shift towards democratizing access to AI. By leveraging edge-computing and GPU capabilities, Network3 AI aims to provide users with enhanced tools that can empower them in various applications. As with any new technology, the anticipation surrounding N3 is likely to generate speculation and excitement within the market, which could lead to increased investment in IOTX as stakeholders look to capitalize on the potential growth.

As the countdown to the launch continues, the community is encouraged to mark their calendars for this pivotal event. The collaboration between Network3 AI and IoTeX signifies a promising future for decentralized technologies and their applications in AI. With the launch just around the corner, all eyes will be on how N3 performs and its impact on the broader blockchain ecosystem.

10 months ago

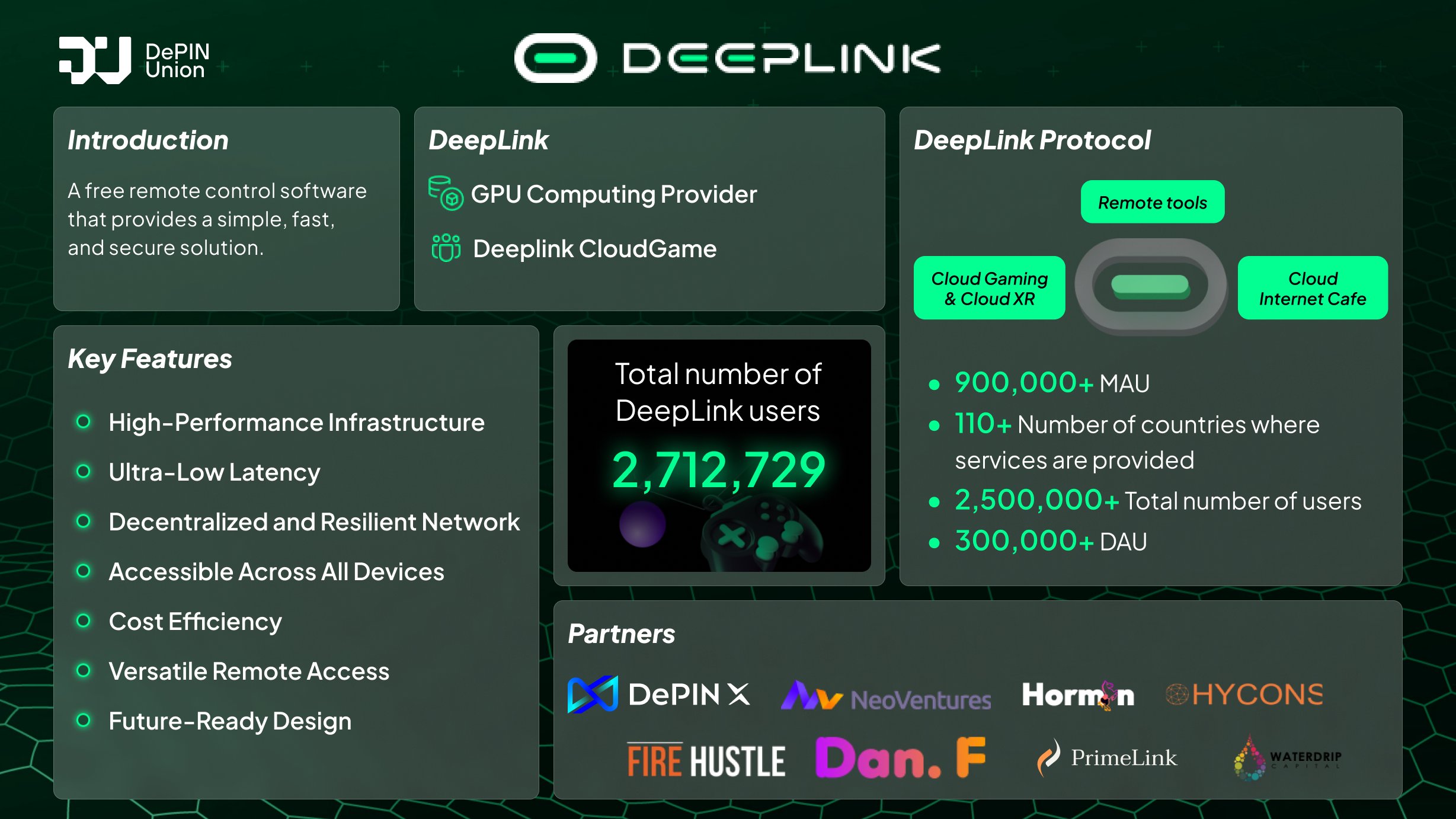

Revolutionizing Cloud Gaming with Decentralized Infrastructure!

DeepLink is breaking boundaries in the gaming world by combining AI, blockchain, and decentralized GPU clusters to deliver ultra-low latency cloud gaming experiences. Designed to make gaming accessible and scalable, DeepLink empowers users to enjoy high-performance gameplay on any device, from AAA games to immersive VR/AR environments.

* Key Features of DeepLink

* ✅ Decentralized GPU Clusters: High-performance GPU clusters ensure seamless gaming experiences without the need for costly hardware upgrades.

* ✅ AI Optimization: Leveraging AI to deliver smooth gameplay, reducing latency, and enhancing visual quality for players worldwide.

* ✅ Accessible Gaming: Turns low-end devices into gaming powerhouses, democratizing premium gaming experiences for all.

* ✅ Blockchain Integration: Enables transparent, secure transactions and decentralization for a trustworthy gaming ecosystem.

* ✅ Scalable & Cost-Effective: From indie developers to AAA publishers, DeepLink offers a flexible and affordable infrastructure for gaming and entertainment.

10 months ago

Evan Park's Insights on DePIN: Key Factors for Success

Evan Park from Tribe Capital has expressed a bullish outlook on Decentralized Physical Infrastructure Networks (DePIN), identifying three primary factors that contribute to his optimism: diverse use cases, sustainability, and significant revenue potential. Tribe Capital has invested in several DePIN projects, including Wynd Networks, which operates Grass, the flight tracking initiative Wingbits, and Akash. Park emphasizes the importance of assessing whether these projects address genuine problems that can generate real demand, indicating a critical approach to evaluating potential investments in this space.

When evaluating DePIN projects, Park is particularly cautious about revenue claims that do not stem from the underlying network. He stresses the need to understand the sources of revenue, questioning whether users also serve as validators and if their contributions to the network directly correlate with revenue generation. Park also prioritizes organic growth and seeks validation of demand, indicating a thorough due diligence process that goes beyond surface-level metrics. A strong team and a founder with deep industry knowledge are significant indicators of a project's potential success in Park's view.

This perspective aligns with insights shared by other industry experts, such as Wyatt Lonergan from VanEck Ventures, who also highlights the importance of project teams in the DePIN sector. Park notes that having domain expertise, alongside crypto-native experience, is crucial for success in this evolving landscape. As DePIN continues to gain traction, understanding these dynamics will be essential for investors and stakeholders looking to navigate this innovative sector effectively.

10 months ago

Solana's Market Dynamics: Challenges and Innovations in Early 2024

In the first half of January 2024, Solana experienced a turbulent period, slipping nearly 4% before a sharp recovery following the release of the U.S. Consumer Price Index (CPI) data, which showed a 2.9% inflation rate. This slip was largely attributed to a broader crypto market malaise, influenced by Bitcoin's volatility, which saw prices briefly dip below $90,000 before rebounding. Despite this, Solana's decentralized finance (DeFi) ecosystem remains robust, with a total value locked (TVL) of approximately $8.7 billion, solidifying its position as the second-largest DeFi network, even as its TVL experienced a slight decline.

The Solana ecosystem faced additional challenges as Mango Markets, a decentralized exchange (DEX) operating on the network, announced its shutdown following a settlement with the U.S. Securities and Exchange Commission (SEC). This closure highlights ongoing regulatory pressures within the crypto space. On a more positive note, institutional interest in Solana-based exchange-traded funds (ETFs) is growing, with projections suggesting that these could attract up to $5.2 billion in their first year. Furthermore, the launch of Nosana's GPU marketplace aims to democratize access to AI computational power, showcasing Solana's commitment to innovation.

Amidst these developments, the Solana meme coin market has seen significant activity, including a notable incident where a trader spent $200,000 in fees to acquire a meme coin, only to incur substantial losses. Additionally, a hack of Litecoin's X account was reported, which scammers exploited to promote a fraudulent Solana-based token. As the market continues to evolve, traders are advised to remain vigilant against scams and verify token sources to protect their investments. Overall, while Solana faces headwinds, its ecosystem's resilience and growth potential remain evident.

10 months ago

DRIFE Accelerates into 2025 with Major Innovations and Expansions

In 2025, DRIFE is set to revolutionize the ride-hailing industry with a series of exciting innovations and expansions. Following a successful 2024, the company plans to broaden its reach into major cities across India, North Africa, Europe, and Southeast Asia. This expansion aims to alleviate the commuting woes of urban dwellers, offering a reliable alternative to traditional transportation. DRIFE's commitment to growth is not just about geographical expansion; it also includes enhancing user experience and engagement through innovative features and services.

One of the standout initiatives is the introduction of token rewards, allowing users to earn DRF tokens through various activities such as sharing location data and referring friends. This gamification of the commuting experience transforms everyday rides into potential side hustles, making it an attractive option for users. Additionally, DRIFE is launching the Infinity Pool, a staking mechanism that connects users' rewards to the performance of multiple cities, thus integrating decentralized finance with global mobility in a novel way.

Moreover, DRIFE is enhancing transparency by putting ride-related data on the blockchain, ensuring users can verify operations through a public dashboard. Personalization features will also be rolled out, tailoring ride experiences to individual preferences. With new ride categories like Ride Now and Scheduled Rides, as well as expanded multi-language support, DRIFE is poised to cater to a diverse user base. As the company gears up for an ambitious year ahead, it invites users to engage and share their thoughts on future expansions, emphasizing a collaborative approach to redefining transportation.

Signup for latest DePIN news and updates