Latest io.net News

a year ago

CreatorBid Partners with io.net to Enhance AI Development through Decentralized GPU Network

In a significant development for the AI Creator Economy, io.net has announced a strategic partnership with CreatorBid, a platform specializing in AI-driven tools for creators and brands. This collaboration will allow CreatorBid to utilize io.net's decentralized GPU network, enhancing the scalability and efficiency of its image and video models. By leveraging this decentralized infrastructure, CreatorBid aims to optimize resource utilization while minimizing costs, making high-performance computing more accessible for businesses engaged in AI technology.

Tausif Ahmed, VP of Business Development at io.net, emphasized the advantages of this partnership, stating that it enables CreatorBid to harness their decentralized GPU network for advanced AI solutions. CreatorBid's CEO, Phil Kothe, echoed this sentiment, highlighting the potential of scalable GPU resources to empower AI Influencers and Agents. This partnership is set to revolutionize content creation, as it allows creators to engage audiences and produce diverse content formats autonomously, paving the way for a new era in digital entrepreneurship.

CreatorBid is at the forefront of the AI Creator Economy, providing tools that enable creators to monetize their content and build vibrant communities around AI Agents. These customizable digital personas facilitate engagement and interaction, fostering co-ownership among creators and fans. By integrating cutting-edge AI tools with blockchain technology, CreatorBid is redefining the creator landscape and positioning itself as a key player in the transition towards an autonomous Creator Economy. The partnership with io.net not only showcases the practical applications of decentralized GPU networks but also accelerates CreatorBid's vision for an AI-driven future in content creation and branding.

a year ago

Top DePIN Altcoins to Watch in December 2024

As November comes to a close and December 2024 approaches, investors are increasingly focusing on portfolio rebalancing and exploring new altcoin opportunities. The Decentralized Physical Infrastructure Network (DePIN) narrative is gaining traction, making it a significant sector to monitor. BeInCrypto has highlighted five top DePIN altcoins to watch in December, including Filecoin (FIL), Arweave (AR), Grass (GRASS), io.net (IO), and NetMind Token (NMT).

Filecoin (FIL) leads the pack with a market capitalization of $3.44 billion. Despite experiencing a decline in value during the second and third quarters, Filecoin has rebounded strongly, with a 56.22% price increase over the last month. Currently, the price momentum is positive, suggesting potential growth to $6.50 in early December. However, if the momentum shifts bearish, it could drop to $4.96. Arweave (AR) follows closely, having increased by 20.98% in the past week, currently priced at $21.13. The altcoin is facing resistance at $22.05, but if it breaks through, it could reach $24.57.

Grass (GRASS) has made headlines with a remarkable 300% increase in October, now priced at $3.48. If it maintains its bullish trend, it may surpass $3.90 and potentially reach $5. io.net (IO), known for being the largest decentralized AI computing network, has seen a 65.13% price increase, currently trading at $2.93. If the bullish trend continues, it could exceed $4. Lastly, NetMind Token (NMT) has surged by 76.10% recently, currently priced at $3.76, with a potential rise above $5 in December if bullish momentum persists. However, profit-taking could lead to a decrease to $2.72. Investors should remain vigilant as market conditions are subject to rapid changes.

a year ago

io.net Partners with OpenLedger to Enhance AI Model Development

This week, decentralized distributed GPU resource platform io.net announced a strategic partnership with OpenLedger, a data blockchain specifically designed for artificial intelligence (AI). This collaboration will enable OpenLedger to utilize io.net's global GPU compute resources, enhancing its ability to refine and train AI models. Known as the Internet of GPUs, io.net provides a powerful network of distributed GPU resources, allowing OpenLedger to accelerate the development of its AI models and empowering developers to create more efficient AI-based decentralized applications (DApps). According to Tausif Ahmad, Vice President of Business Development at io.net, this partnership will provide OpenLedger with a reliable infrastructure to scale its AI models and unlock new use cases, reinforcing its position as an innovative provider in the decentralized AI space.

In addition to providing GPU resources, io.net's infrastructure will support the inference and hosting of AI models, ensuring optimal performance and scalability. This partnership is expected to enhance OpenLedger's reputation as a leading provider of reliable datasets, fueling innovation at the intersection of blockchain and AI. The collaboration aims to create high-quality data securely and efficiently while driving innovation and performance. A team member from OpenLedger emphasized that leveraging io.net's GPU infrastructure will allow users to fine-tune AI models more efficiently, ultimately leading to the development of trustworthy and explainable AI models.

A significant factor in OpenLedger's choice of io.net as its GPU resource provider is the cost-effective and scalable compute solutions offered. This partnership will enable OpenLedger to expand its services without the constraints of high costs associated with centralized cloud providers. By processing larger datasets and developing AI models with unprecedented efficiency, OpenLedger aims to push the boundaries of decentralized AI innovation. Ultimately, this partnership aligns with OpenLedger's mission to foster an open, collaborative data environment while promoting the adoption of blockchain-powered AI solutions.

a year ago

io.net Partners with Zero 1 to Boost Decentralized AI Development

Decentralized Physical Infrastructure Network (DePIN) io.net is making strides in the decentralized AI (DeAI) sector by expanding its GPU Compute connection services to Zero 1 Labs. This collaboration aims to enhance the development of DeAI by providing Zero 1 with access to high-performance GPU compute power. The partnership is expected to facilitate the training of AI agents for Keymaker, Zero 1's open marketplace, thereby accelerating the overall development of decentralized AI applications. Developers and users on the Zero 1 platform will benefit from demand-based, cost-effective GPU computing, making it easier to utilize tools for building and deploying DeAI applications.

Zero 1 operates as a proof of stake-based decentralized AI ecosystem, allowing innovators and developers to create optimized DeAI applications with Fully Homomorphic Encryption (FHE). This ensures secure data governance and privacy at the AI computation level. The partnership with io.net will enhance Zero 1's computing capabilities, particularly for Keymaker, which serves as a multimodal AI marketplace. With over 100 DeAI tools available, the marketplace is designed to facilitate the creation and discoverability of DeAI applications, catering to developers aiming to build effective on-chain AI agents.

In addition to GPU compute services, io.net and Zero 1 Labs are committed to fostering innovation through joint initiatives, including hackathons and bounty programs. These community-driven events will allow developers to collaborate and share their experiences, enriching the DeAI ecosystem. The strategic exchange of resources between the two entities will enable projects within Zero 1's ecosystem to access advanced AI expertise and high-performance resources from io.net. Ultimately, this partnership is poised to enhance Zero 1's market share in the DeAI developer landscape while reducing infrastructure costs, thereby accelerating innovation in the decentralized AI space.

a year ago

io.net and NovaNet Launch zkGPU-ID for Enhanced GPU Verification

In a significant move to bolster transparency and reliability in decentralized GPU-powered applications, io.net, a decentralized physical infrastructure network (DePIN), has announced a partnership with NovaNet, a decentralized incentive network focused on privacy preservation through zero-knowledge proofs. This collaboration aims to introduce a groundbreaking zero knowledge GPU identification technology, referred to as zkGPU-ID. By implementing this innovative system, io.net will ensure that its GPU resources consistently deliver the promised performance levels, thereby enhancing user confidence in the quality and authenticity of decentralized compute assets.

The zkGPU-ID system employs advanced cryptographic techniques to verify that the GPUs on io.net meet or exceed their advertised capabilities. Utilizing NovaNet's zero-knowledge proof technology, io.net can validate GPU specifications without disclosing sensitive information, thereby reinforcing both privacy and robust verification. This solution empowers users to not only confirm the performance of GPUs but also their authenticity, adding a crucial layer of security to decentralized computing networks. According to Tausif Ahmed, io.net’s VP of Business Development, this partnership will optimize coordination and verification across a vast network of distributed GPU suppliers, ensuring that customers can trust the GPUs they rent from io.net.

To achieve its objectives, the zkGPU-ID utilizes a zero knowledge virtual machine (zkVM) to assess GPU specifications and generate cryptographic proofs that validate various performance levels. This process produces tamper-proof evidence, and any attempts to manipulate the details will result in invalid proofs, thereby securing the network's integrity. Wyatt Benno from NovaNet emphasized that their zkVM provides a secure and scalable method for GPU verification, ensuring reliable performance guarantees. The collaboration between io.net and NovaNet is poised to redefine standards for transparency and reliability in decentralized compute infrastructure, making zkGPU-ID an essential tool for users reliant on GPU resources.

a year ago

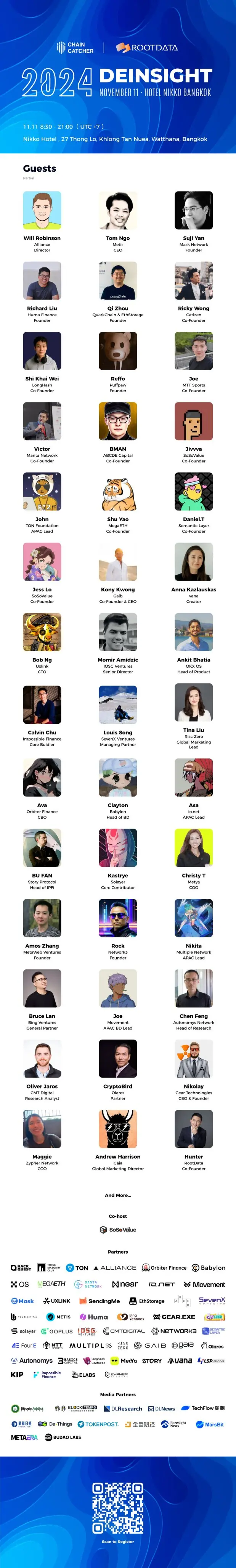

Asa Confirms Attendance at DeInsight 2024 Summit in Bangkok

Asa, the head of io.net for the Asia-Pacific region, has confirmed attendance at the upcoming "DeInsight 2024" annual summit, scheduled for November 11 in Bangkok during Devcon. io.net is a decentralized computing network designed to support the development, execution, and scaling of machine learning applications on the Solana blockchain. The platform boasts the world's largest GPU cluster, aggregating 1 million GPUs from underutilized resources such as independent data centers, crypto miners, and projects like Filecoin and Render. This innovative approach addresses the need for vast computing power by creating a decentralized physical infrastructure network (DePIN), making it accessible, customizable, cost-effective, and easy to implement for engineers.

The "DeInsight 2024" annual summit will be held at Hotel Nikko Bangkok and is co-hosted by ChainCatcher and RootData, with Soso Value as a co-organizer. The event aims to gather over 1,000 industry elites from the Web3 field to exchange insights and discuss the latest trends and developments in the blockchain space. A highlight of the summit will be the unveiling of the RootData List 2024, which ranks influential individuals and institutions in the industry based on objective data analysis. This annual ranking is expected to provide valuable insights into the key players shaping the future of blockchain technology.

ChainCatcher emphasizes the importance of viewing blockchain developments rationally and encourages attendees to enhance their risk awareness regarding virtual token issuances and speculations. It is crucial for participants to understand that all content provided on the platform is market information or opinions from related parties and should not be interpreted as investment advice. The organization also encourages readers to report any sensitive information they may encounter, ensuring a responsible and informed community engagement.

a year ago

io.net Partners with ParallelAI to Enhance GPU Computing for AI

In a significant development within the blockchain and AI sectors, io.net, a pioneering decentralized physical infrastructure network (DePIN) GPU platform, has announced a strategic partnership with ParallelAI. This collaboration aims to enhance the capabilities of both platforms by integrating io.net's tools into ParallelAI's infrastructure, which specializes in parallel processing optimization for AI applications. The partnership is expected to bolster GPU computational facilities on IO Cloud, particularly through the deployment of A100 GPUs, allowing AI developers to efficiently conduct tasks such as large language model (LLM) training and distributed deep learning.

The partnership will not only focus on expanding computational resources but also on joint research and development efforts. By leveraging their combined expertise, io.net and ParallelAI aim to push the boundaries of GPU cloud computing, setting new standards for performance and efficiency. This collaboration follows io.net's previous partnerships, including a notable alliance with FLock to develop a Proof-of-AI (PoAI) consensus mechanism, further solidifying its position in the AI and DePIN landscape.

ParallelAI's innovative approach allows developers to write high-level code while the platform manages parallel computing across multiple GPUs and CPUs. This can lead to a remarkable reduction in computational time—up to 20 times faster—and significant cost savings. By utilizing decentralized GPU clusters on demand through IO Cloud, ParallelAI can scale its operations seamlessly, ensuring clients have reliable access to the computational power needed for intensive AI workloads, with potential savings of up to 90% compared to traditional cloud services.

a year ago

HashKey Global and Ionet to Discuss AI Integration in Upcoming AMA

On October 17, 2024, HashKey Global will host an Ask Me Anything (AMA) session with Ionet, focusing on the innovative ways Io.net plans to leverage Decentralized Physical Infrastructure Networks (DePIN) to enhance artificial intelligence (AI) capabilities. This event is expected to provide valuable insights into the strategic direction of Io.net and how it aims to scale its AI initiatives. Given the growing interest in AI and blockchain integration, the AMA could serve as a pivotal moment for investors and stakeholders in the IO token ecosystem.

The discussion is anticipated to shed light on the potential impacts of successful AI integration on the IO token's market performance. As the demand for AI-driven solutions continues to rise, the ability of Io.net to effectively implement these technologies could significantly boost investor confidence. This, in turn, may lead to an increase in the IO token's price, making it a more attractive option for both current and prospective investors.

HashKey Global's commitment to fostering dialogue around blockchain and AI is evident in this AMA. By engaging with the community and providing a platform for discussion, they aim to clarify the future of Io.net and its role in the evolving landscape of decentralized technologies. Stakeholders are encouraged to stay informed about the developments from this session, as the insights shared could have lasting implications for the IO token and its market trajectory.

a year ago

Coinbase to Support AI-Focused Altcoin io.net on Solana Network

Coinbase has announced that it will be adding support for the artificial intelligence-focused altcoin, io.net (IO), on the Solana (SOL) network. This addition marks a significant step for the decentralized physical infrastructure network (DePIN), which aims to leverage idle graphics processing units (GPUs) for machine learning (ML) and AI projects. According to Coinbase, trading for IO will commence on or after 9 a.m. Pacific Time on October 9th, 2024, contingent upon meeting liquidity conditions. The trading will be initiated in phases, and it is important to note that support for IO may be limited in certain jurisdictions.

At the time of writing, IO is trading at $1.77, reflecting a decline of over 3% in the past 24 hours. With a market capitalization of $168 million, io.net ranks as the 295th-largest cryptocurrency project. The project aims to democratize access to computing power by aggregating over one million GPUs from independent data centers, crypto miners, and other crypto projects like Filecoin and Render. This initiative is particularly timely given the increasing demand for GPU compute resources driven by the rapid growth of AI and ML workloads.

The io.net project emphasizes its mission to make computing more scalable, accessible, and efficient. Current major cloud providers possess approximately 10-15 exaFLOPS of GPU compute capacity. However, the anticipated demand for GPU compute in the cloud could surge to between 20-25 exaFLOPS, reflecting the escalating requirements for AI/ML model training and inferencing. As the cryptocurrency market continues to evolve, the integration of AI-focused projects like io.net could play a pivotal role in shaping the future of decentralized computing.

a year ago

The Rise of DePIN: Revolutionizing Tech Infrastructure

As AI evolves and the need for more computational power increases, the demands on digital infrastructure have never been greater. DePIN, or decentralized physical infrastructure networks, is a groundbreaking approach poised to revolutionize business operations. Traditional centralized models struggle to keep up with growing demands, while DePIN leverages distributed networks for flexibility, scalability, and resilience. Tory Green, CEO of Io.net, highlights the limitations of traditional systems and the benefits of DePIN in terms of scalability, cost efficiency, and resilience.

Advantages of DePIN

One of DePIN's key advantages is its unparalleled scalability by utilizing underutilized global resources. IO.net aggregates GPUs worldwide, offering nearly unlimited compute capacity. Cost efficiency is another highlight, as DePIN significantly reduces infrastructure costs by leveraging idle resources, making high-performance computing accessible to startups. In terms of resilience, DePIN outperforms traditional models by eliminating single points of failure. With decentralized nodes distributed globally, tasks like AI model training can be performed with lower latency, improving efficiency and reliability.

Benefits for Users

Users working with IO.net's decentralized network benefit from affordable, scalable compute power, particularly advantageous for smaller companies and startups. Compared to traditional cloud providers, IO.net offers substantial cost savings, unlimited compute capacity, and enhanced reliability. Users can enjoy more compute power for less cost, with added flexibility, allowing them to focus on their core business operations.

Signup for latest DePIN news and updates