CUDIS Launches Energy Journal Feature to Enhance Wellness Tracking

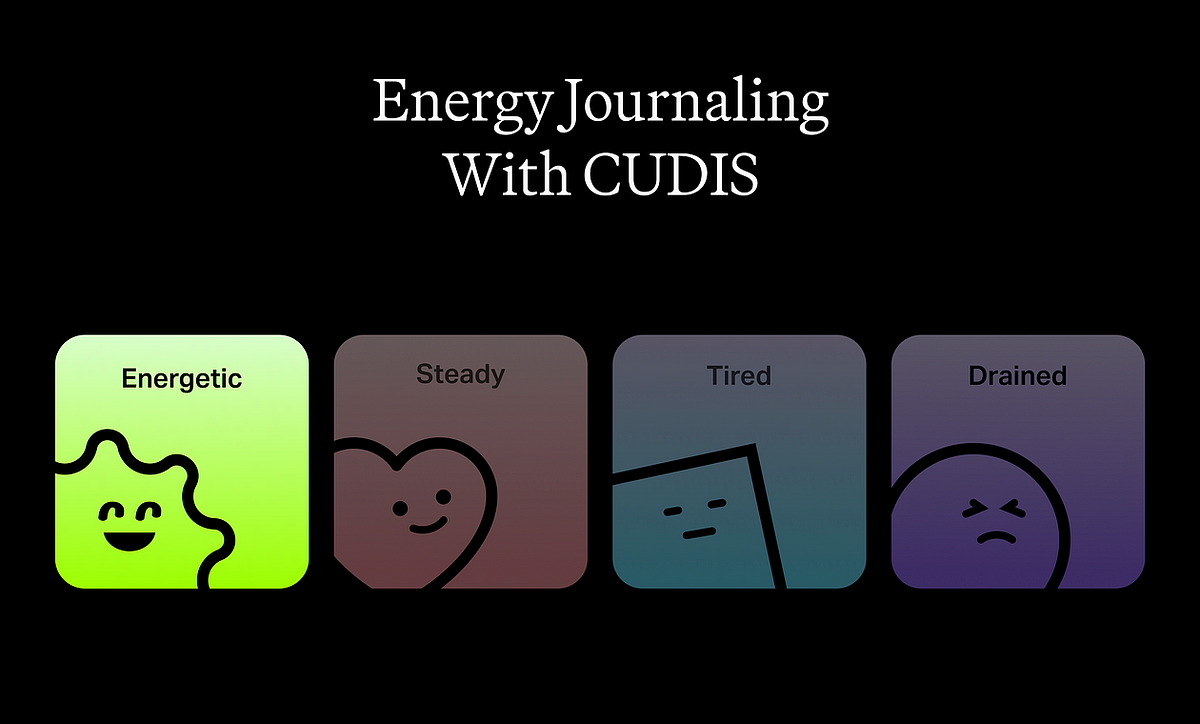

CUDIS has recently launched version 1.3.10 of its app, introducing an innovative feature called the Energy Journal. This new functionality allows users to log their daily energy and mood levels on the blockchain, creating a permanent record that can significantly enhance sentiment studies and personal wellness algorithms. By tracking energy levels, users can gain insights into their mental and physical well-being, which can lead to positive changes in their lives. The data is securely stored on-chain, ensuring its immutability and contributing to the expanding CUDIS ecosystem.

Tracking energy levels is essential for understanding one’s mental health, similar to monitoring sleep quality and stress. The CUDIS AI Agent analyzes the self-reported data alongside other health metrics, providing personalized insights and actionable advice. Users are encouraged to log their energy levels consistently, honestly, and to recognize both positive and negative triggers. This practice not only fosters self-awareness but also allows users to earn in-app rewards such as raffle entries and SALUS points, incentivizing them to maintain their tracking routine.

CUDIS rewards users for their commitment to logging energy levels, offering various incentives based on streaks of consistent tracking. For example, a 7-day streak earns users 2 raffle entries and 100 SALUS points, while a 60-day streak can yield 7 raffle entries and 1,000 SALUS points. The raffles provide a guaranteed chance to win exciting rewards, including Edamame NFTs and USDC prizes. Additionally, SALUS points can be redeemed within the CUDIS marketplace and are linked to early user adoption airdrops during the upcoming CUDIS Token Generation Event (TGE). This unique approach not only enhances user engagement but also promotes a healthier lifestyle through the power of blockchain technology.

Related News