The Rise of Decentralized Physical Infrastructure Networks and Consumer Engagement

In 2013, Helium was founded to create a wireless infrastructure that could support the rapidly growing Internet of Things (IoT) industry. By 2018, the company pivoted towards a decentralized wireless network model, allowing devices worldwide to connect to the Internet without relying on traditional, power-hungry satellite systems or costly cellular plans. Utilizing token incentives, Helium’s network expanded rapidly, boasting over 375,000 hotspots and establishing itself as the largest long-range wide-area network (LoRaWAN) and the fastest-growing cellular network. This innovative approach has inspired over 1,400 Decentralized Physical Infrastructure (DePIN) projects, collectively valued at over $53 billion, demonstrating the potential of blockchain technology to create real-world value through decentralized systems.

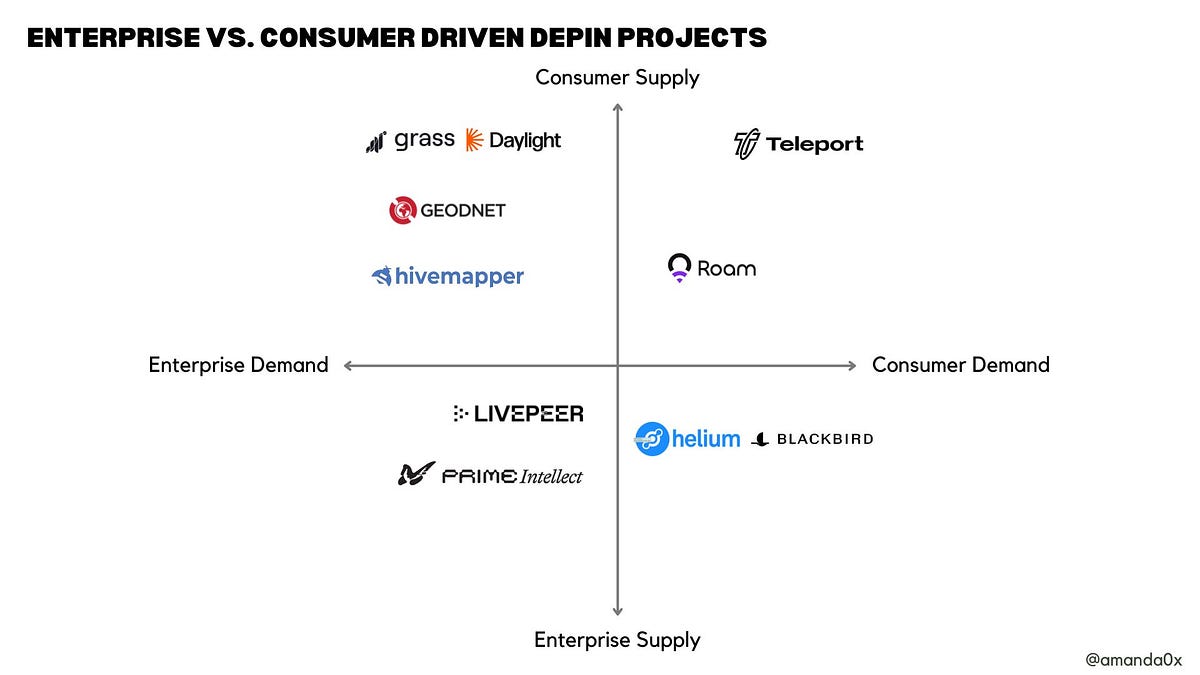

Consumers play a crucial role in the DePIN ecosystem, acting as the supply backbone for various networks in exchange for token rewards. These networks can be categorized into physical resource networks, which incentivize consumers to contribute to real-world infrastructure, and digital resource networks, where consumers help build virtual infrastructure. For instance, decentralized energy networks rely on consumers to connect distributed energy resources like solar panels, while decentralized mapping projects leverage consumer-grade hardware to gather location data. Additionally, consumers can contribute their computing power and bandwidth to decentralized compute platforms, enhancing the capabilities of AI and machine learning applications.

As DePIN projects evolve, they are increasingly generating revenue and attracting consumer demand. By tapping into consumer marketplaces and offering direct-to-consumer products, these projects can streamline customer acquisition and enhance user engagement. The DePIN model not only incentivizes new consumer behaviors but also accelerates the adoption of existing ones, particularly in the energy sector. As these networks grow, they unlock new applications and services, creating a flywheel effect that attracts developers and increases consumer adoption. Overall, the intersection of consumers and DePIN is paving the way for innovative solutions and a more decentralized future.

Related News