Theta EdgeCloud Enhances Payment Options with TFUEL Support

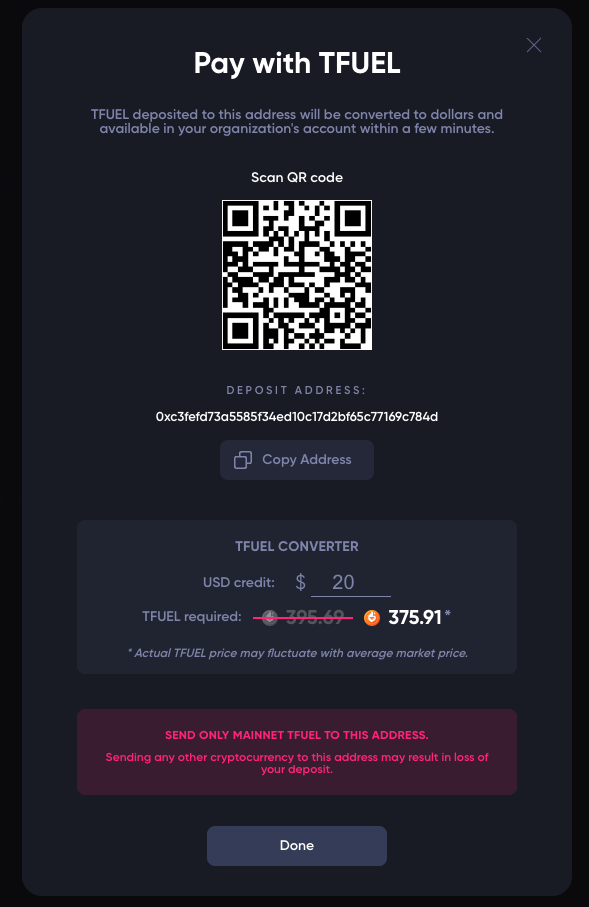

Theta EdgeCloud has introduced a significant enhancement by enabling Theta Fuel (TFUEL) billing for its services. This change positions TFUEL as the primary payment method for EdgeCloud, mirroring its role for the thousands of global Edge Nodes that support the network. Users opting to pay with TFUEL tokens will benefit from a 5% discount on their service fees, which encompass AI inference and training, video livestreaming, and future video/game rendering functionalities. This strategic move not only incentivizes the use of TFUEL but also strengthens its integration into the broader Theta ecosystem.

The adoption of EdgeCloud has seen remarkable growth, particularly within academic institutions in the United States and South Korea. Notable universities such as the University of Oregon, Korea University, and Yonsei University are leveraging EdgeCloud’s hybrid cloud GPU infrastructure to propel AI research forward. This trend highlights Theta’s dedication to fostering academic innovation by providing vital computational resources for complex AI projects. Additionally, corporate clients like Jamcoding, a leader in e-learning coding platforms, are utilizing EdgeCloud to address critical AI applications, including computer vision and large language model training, further embedding EdgeCloud into the Theta token economy.

While the support for USD remains essential for attracting Web2 customers, the Theta ecosystem is designed to function as a decentralized economy, where fiat transactions are converted into TFUEL purchases. This ensures that all EdgeCloud activities contribute to the on-chain economy of Theta, even when initiated by non-crypto users. With the recent launch of EdgeCloud Mobile, the potential for integration with the 3.9 billion Android devices worldwide opens new avenues for AI applications. As the AI market is projected to grow significantly, the core payment structure of EdgeCloud will ensure that TFUEL and the Theta token economy remain central to its operations.

Related News