TPLAY Wins at Theta Hackathon: A New Era of Decentralized Video Sharing

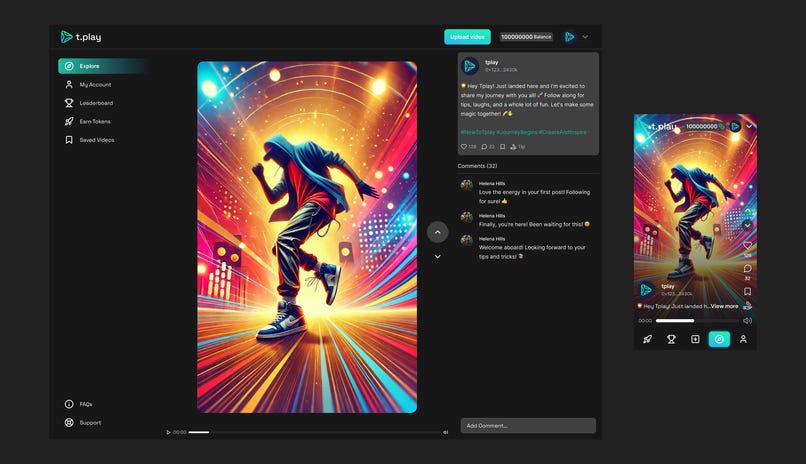

The recent Theta Hackathon has concluded successfully, showcasing an impressive array of projects focused on AI, video, and gaming. This event highlighted the contributions of talented developers and teams who are dedicated to building a decentralized future for media and entertainment. Among the standout projects, TPLAY emerged as the winner of the Video/Rendering track. TPLAY is a revolutionary social network designed for sharing videos on the Theta Network, allowing users to upload or create AI-generated videos, engage in contests, and win exciting prizes. This platform not only transforms video content creation and sharing but also offers a unique blend of technology and creativity.

TPLAY is more than just a video-sharing platform; it is a comprehensive ecosystem that empowers users to control their content. Users can securely upload and share videos, utilize decentralized storage solutions, and leverage advanced AI tools for video creation. The platform encourages user engagement through weekly contests where participants can win prizes based on audience interaction. Additionally, TPLAY offers interactive features such as liking, commenting, and sharing videos, along with real-time updates on contest standings and video processing, enhancing community engagement.

The technical architecture of TPLAY integrates modern web technologies with the Theta Network blockchain, facilitating user interactions through decentralized wallets. The platform processes video uploads and manages blockchain interactions via smart contracts, ensuring secure token transactions and contest management. Future enhancements for TPLAY include the introduction of advanced AI tools for video editing, the establishment of a DAO for user-driven feature proposals, and a transition to a fully decentralized storage solution. Congratulations to the winning team for their innovative contributions to the Theta Ecosystem!

Related News