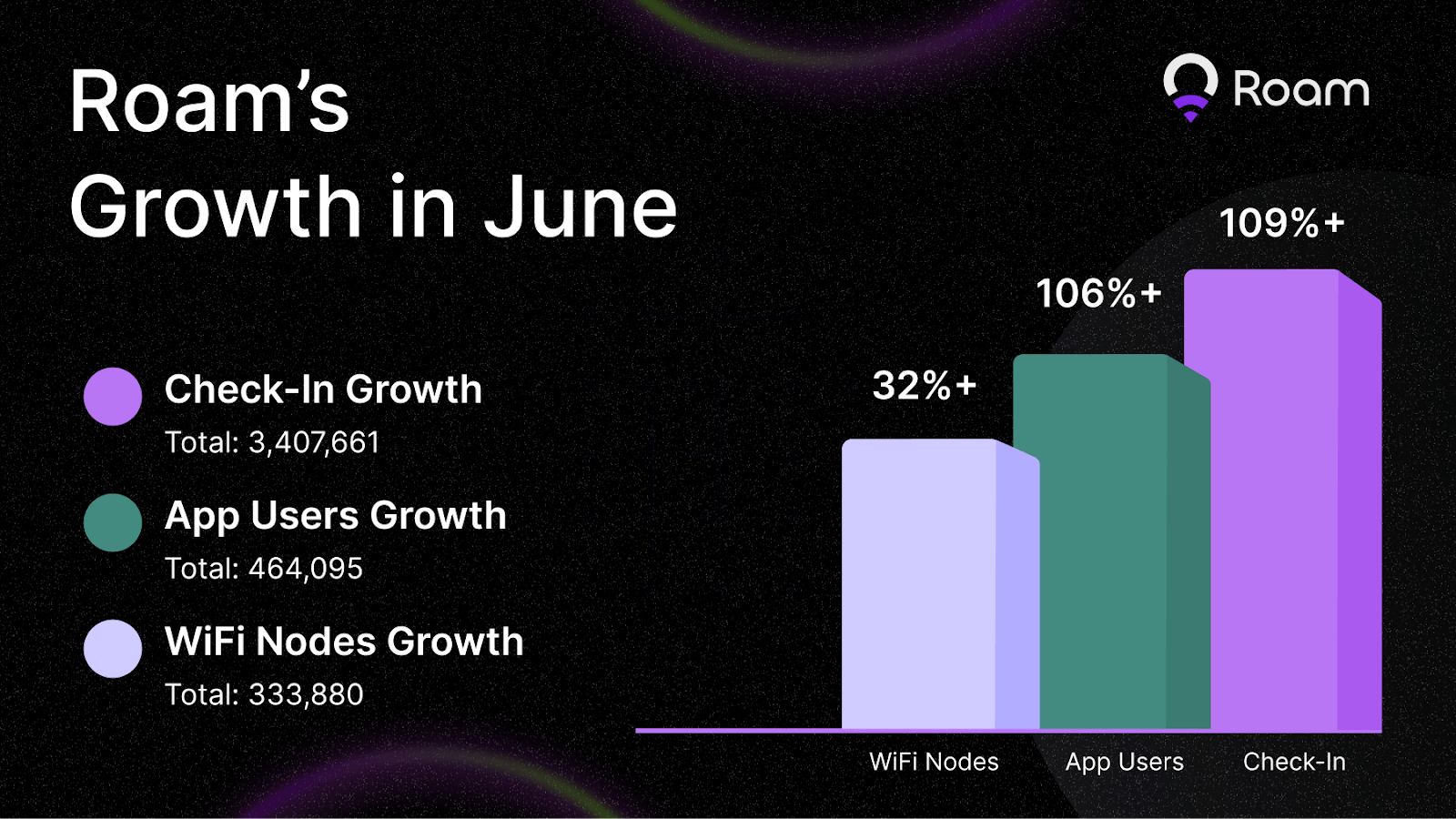

Roam Reports June Growth and Expansion

Roam, a DePIN project, has reported significant growth in June, with over 464,000 active app users and 333,000 deployed nodes worldwide. The project has achieved over 321.6 million Roam Points for conversion to $ROAM tokens post-TGE. Roam’s community engagement is evident through the Roam x OKX Wallet Giveaway event, which attracted over 100,000 participants. The project has also launched on the Solana Mobile dApp store, integrating with the world’s most Web3-focused phone, the Saga phone, to provide faster load times and superior connectivity. Roam has partnered with APhone cloud devices and Coral App to enhance WiFi roaming and introduce Roam miners for new connectivity and earning opportunities. MetaBlox Labs, the developer of Roam, has been recognized by the Wireless Broadband Alliance as a Certified Access Network Provider for OpenRoaming™, reflecting Roam’s commitment to seamless and secure WiFi access.

Related News