Nubila Secures $2.5 Million in Funding for ESG Data Oracle Expansion

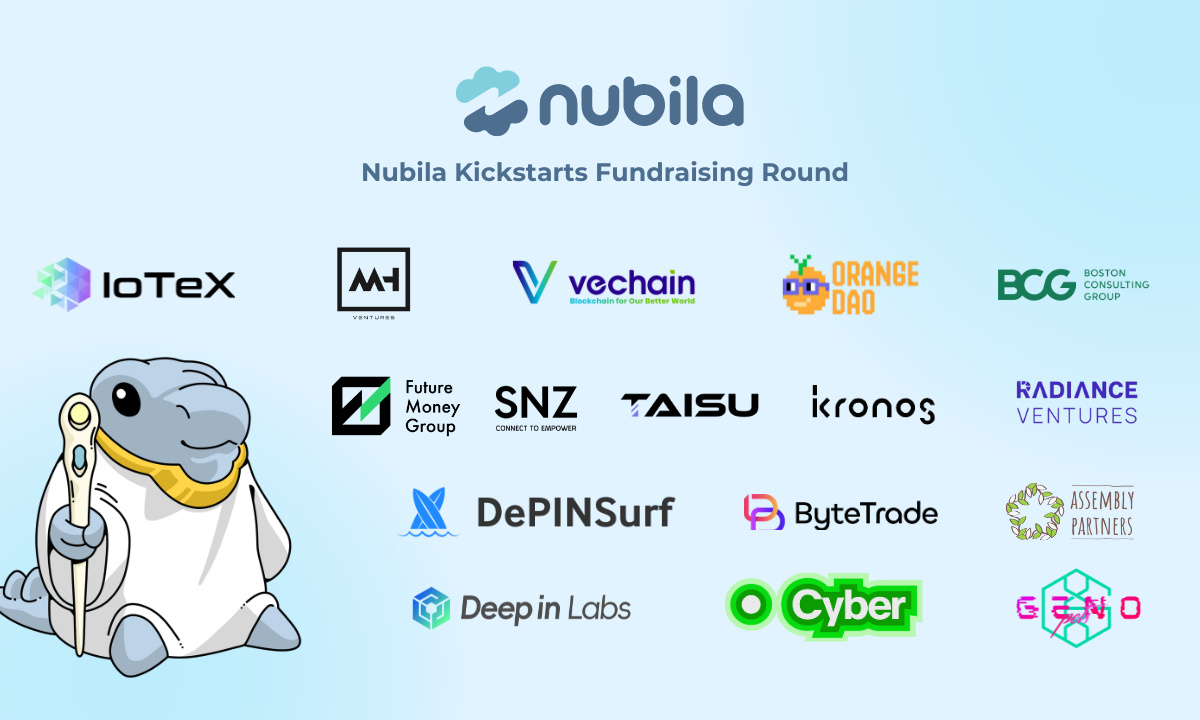

Nubila, a leading data oracle in the Decentralized Physical Infrastructure Network (DePIN) ecosystem, has initiated a fundraising round. The round is led by IoTeX and VeChain, along with the Boston Consulting Group, and has attracted participation from a diverse group of investors including OrangeDAO, MH Ventures, Future Money Group, and others. To date, Nubila has secured $2.5 million in funding. This investment reflects the industry’s recognition of Nubila’s potential to use AI and tokenization to enhance decision-making, promote sustainable development, and create financial products with ESG data. Nubila’s founder, Ben, envisions building the infrastructure for the MachineFi revolution by establishing a network of advanced weather stations and sensors to capture critical environmental data. The integration of real-time ESG data into AI models, such as Microsoft’s Aurora atmospheric model, will improve ESG assessments and drive more informed and sustainable decision-making across various industries. With the new funding, Nubila aims to scale its operations and expand its global reach to contribute significantly to the planet’s sustainability and well-being. The funds will be used to scale Nubila’s operations, develop its ESG Data Oracle, and pursue strategic goals like enhancing data accuracy, expanding the network’s reach, and increasing user engagement and awareness of sustainable investment. Raullen Chai, Founder of IoTeX, praises Nubila for leveraging DePIN and AI to transform ESG data management, noting the revolutionary approach of creating a decentralized ESG network of community-owned IoT devices. Nubila has deployed 16,000 advanced weather stations worldwide, capturing over 100TB of weather data for accurate ESG assessments. Headquartered in San Francisco, Nubila is dedicated to transforming sustainability initiatives through innovative solutions within the DePIN ecosystem, using AI and ESG tokenization to empower decision-making and drive sustainable development.

Related News